Alphabet Inc. (GOOGL) Analysis with StockOracle™ November 2025

By Piranha Profits TeamLast updated on October 30, 2025

Alphabet’s Q3 2025 earnings reignited investor confidence, delivering its first-ever $100 billion quarter and proving its growth engine is alive and well. Revenue and EPS surged. From the StockOracle™ view, Alphabet is a financially intelligent giant with durable advantages in data, scale, and network effects.

Why is Alphabet (GOOGL) Up after Q3 Earnings 2025

Alphabet delivered what CEO Sundar Pichai called a “terrific” third quarter in 2025, marking one of its strongest performances in years. The company reported $102.3 billion in revenue, up 16% year-over-year, achieving its first-ever $100 billion quarter—a milestone that Pichai highlighted by saying,

“Five years ago, our quarterly revenue was at $50 billion. Our revenue number has doubled since then, and we're firmly in the Generative AI era.”

Alphabet (GOOGL) earnings call transcript and press release powered by StockOracle™ - November 2025

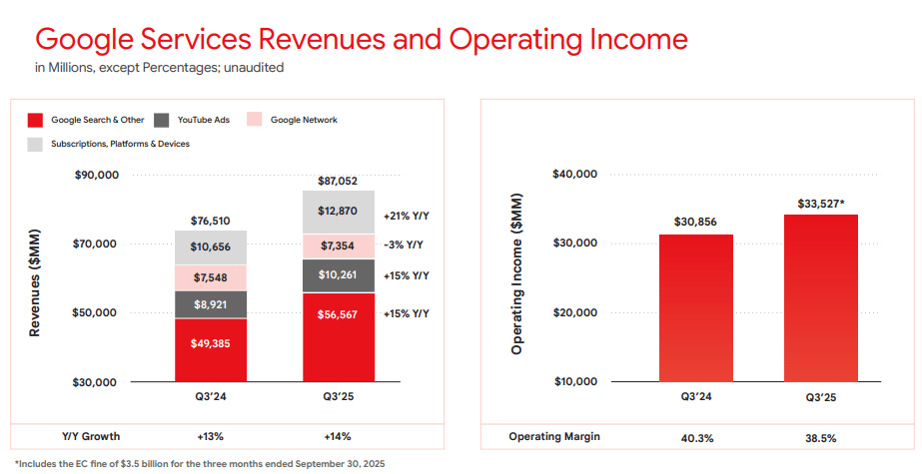

Growth was broad-based, with Google Services rising 14%, driven by Search, YouTube Ads, and Subscriptions, while Google Cloud surged 34% to $15.2 billion on strong enterprise AI adoption.

Profitability followed suit, with net income up 33% to $35 billion and EPS up 35% to $2.87. Alphabet also showcased its expanding AI and cloud leadership, processing 1.3 quadrillion monthly tokens (a 20× increase year-over-year) and growing its Cloud backlog 82% to $155 billion, while surpassing 300 million paid subscribers across Google One and YouTube Premium

Image Source from : https://s206.q4cdn.com/479360582/files/doc_financials/2025/q3/2025q3-alphabet-earnings-slides.pdf

StockOracle’s OracleIQ™ Analysis on Alphabet (GOOGL)

Alphabet’s blockbuster Q3 2025 earnings reignited investor confidence, sending its stock soaring as markets rewarded its renewed growth momentum in AI and Cloud. Beyond the numbers, the real story lies in why the business performed so strongly. Now, let’s view Alphabet through the StockOracle™ lens with OracleMoat™ revealing its competitive strength and OracleIQ™ highlighting its financial intelligence to understand why the company’s fundamentals truly stood out.

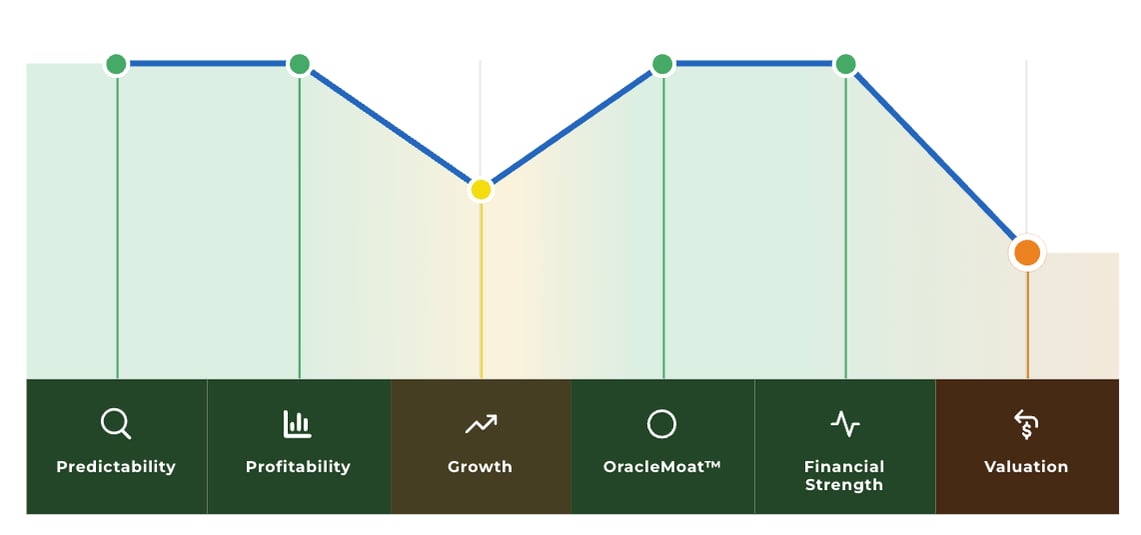

Alphabet (GOOGL) OracleIQ™ powered by StockOracle™ - November 2025

The OracleIQ™ profile for Alphabet reflects a company with exceptionally strong fundamentals and balanced growth. Based on OracleIQ™, Alphabet scores near the top in Predictability, Profitability, OracleMoat™, and Financial Strength, showing it operates with consistency, efficiency, and a durable competitive edge.

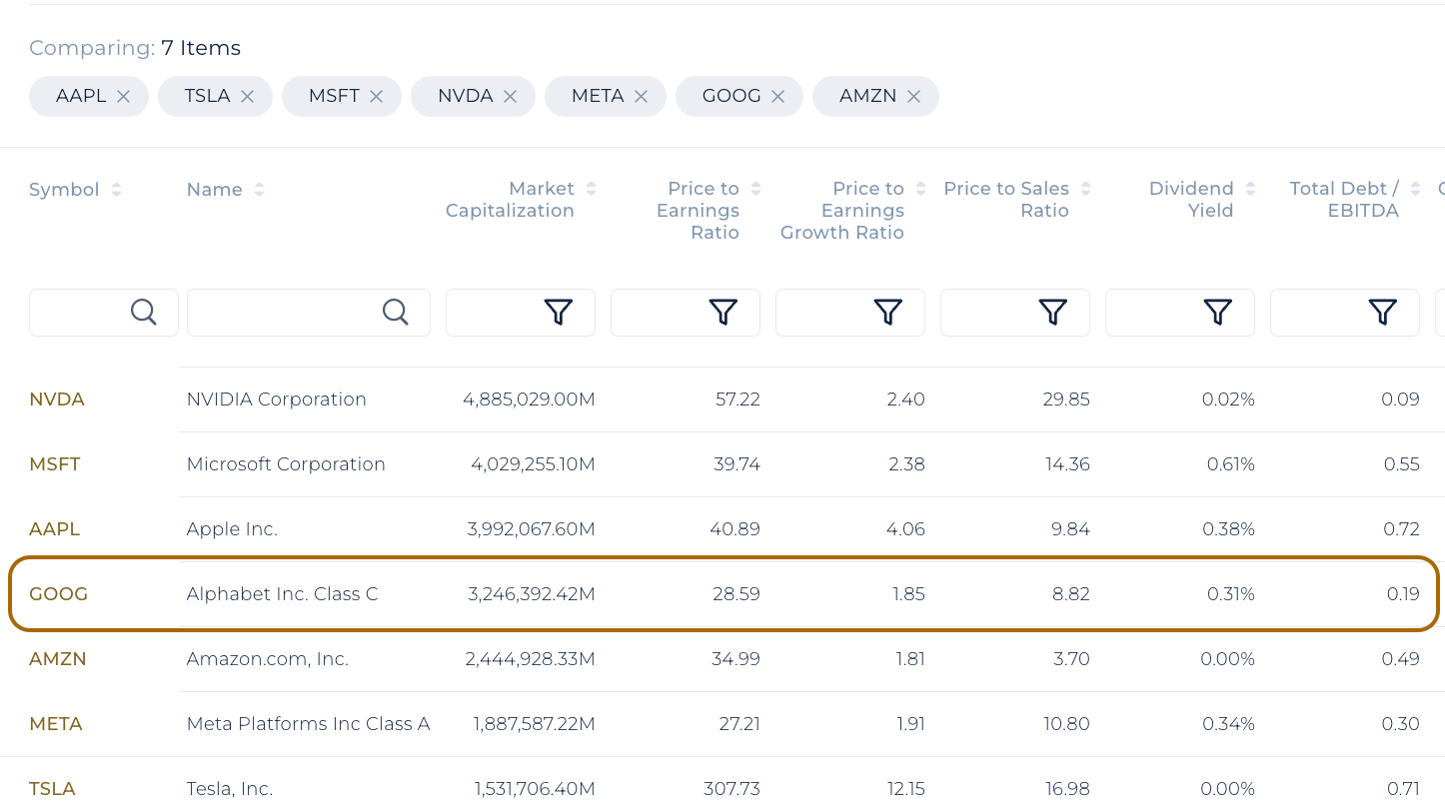

Comparison Table of the Magnificent 7 powered by StockOracle™ - November 2025

Alphabet is priced for quality, yet it still ranks among the more affordable names in the Magnificent Seven. A premium company that continues to trade at a reasonable relative value.

Alphabet (GOOGL) Predictability Rank

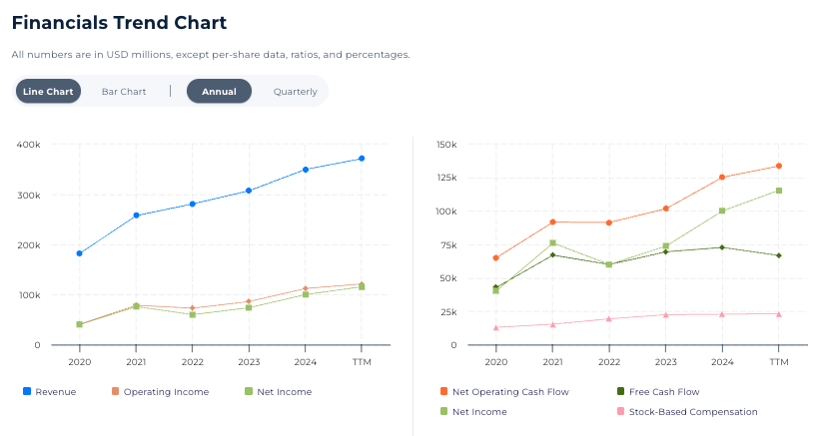

Financials Trend Chart of Alphabet (GOOGL) powered by StockOracle™ November 2025

Year after year, Alphabet has expanded both its top and bottom line, with revenue climbing from around $200 billion in 2020 to nearly $400 billion TTM, and net income following the same disciplined upward path.

Operating income and free cash flow mirror this consistency, showing a business that scales efficiently without the volatility typical of high-growth tech firms.

In short, Alphabet’s OracleIQ™ Predictability score reflects a company built for endurance. Search, YouTube, Cloud, and subscriptions act like stabilizing pillars, cushioning against sector swings. This isn’t a stock that surprises investors quarter to quarter; it delivers, almost mechanically.

Alphabet (GOOGL) Profitability Rank

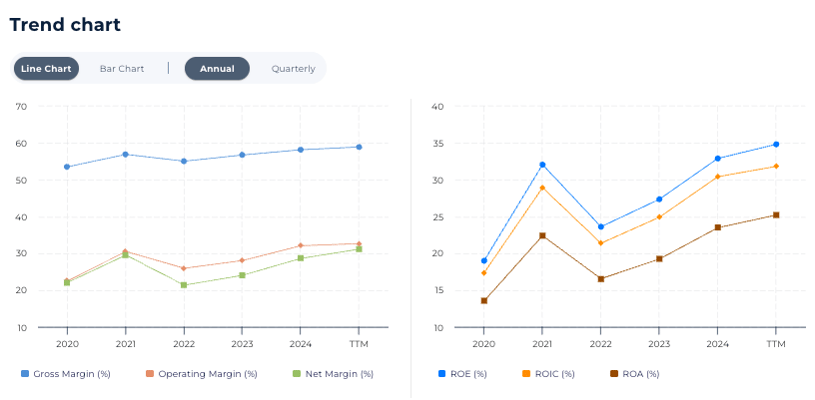

Profitability Trend Chart of Alphabet (GOOGL) powered by StockOracle™ - November 2025

Alphabet’s profitability profile shows consistency and scale efficiency. The charts show gross margins hovering near 60%, holding steady over time. A strong sign of pricing power and cost control across its core platforms. Both operating and net margins have trended upward since 2022, reflecting disciplined expense management and rising contributions from high-margin segments.

On the return side, ROE (Return on Equity) and ROIC (Return on Invested Capital) have climbed sharply toward the mid-30% range in the trailing twelve months, while ROA (Return on Assets) sits comfortably above 20%.

Alphabet’s profitability story isn’t about erratic spikes or one-off quarters; it’s about a business that compounds earnings.

Alphabet (GOOGL) Growth Rank

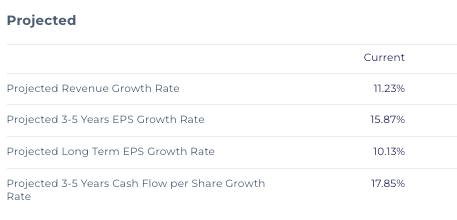

Projected Growth Rate of Alphabet (GOOGL) powered by StockOracle™ - November 2025

From the StockOracle™ lens, Alphabet’s growth remains steady and reliable. Projections show revenue rising 11%, EPS up 15–16%, and cash flow per share expanding nearly 18% over the next few years.

What does OracleMoat™ says about Alphabet (GOOGL) November 2025

Alphabet earns a 9/10 Wide Moat score in OracleMoat™, reflecting one of the most defensible positions in global tech. It maintains dominance through network effects, scale, and data-driven infrastructure. Its moat is built on decades of technological investment, making its advantages durable for decades to come.

Brand loyalty is strong but tempered by limited pricing power since most products are free and ad pricing depends on auctions. Barriers to entry are nearly impenetrable, supported by proprietary algorithms, vast datasets, and costly infrastructure. Switching costs are modest for consumers but higher for enterprise clients using Google Cloud and Workspace. The network effect remains Alphabet’s crown jewel. Each user interaction improves data, targeting, and engagement, further widening its lead. Finally, economies of scale amplify its moat, allowing Alphabet to operate efficiently, invest aggressively in AI and infrastructure, and outspend competitors with ease.

Yet, Google’s supremacy faces new tests. The rise of large language models (LLMs) challenges the traditional search model that powers its core revenue. While Alphabet is integrating AI into Search and Ads to stay ahead, the speed of disruption means its moat, though wide must keep evolving to stay relevant.

Related

Microsoft (MSFT) reported earnings on 29th January 2026, with GAAP net income and EPS both growing ...

As of 3 Feb 2026, StockOracle™ 's OracleValue™ model estimates Alphabet's (GOOG Stock) intrinsic ...

The Magnificent 7 are basically the seven dominant U.S. technology stocks that have driven much of ...

.png)