Apple (AAPL) Intrinsic Value StockOracle™ Analysis After Q1 2026 Earnings

By Piranha Profits TeamLast updated on February 12, 2026

Apple’s Q1 2026 earnings was defined by one core reality. Demand outran supply.

Tim Cook said Apple “exited December with very lean channel inventory due to a staggering level of demand,” adding that the company is now in “a supply chase mode to meet the very high levels of customer demand.”

Whether viewed as a warning or a blessing for investors, Apple (AAPL) has rallied nearly 10% since its earnings release on 29th January 2026.

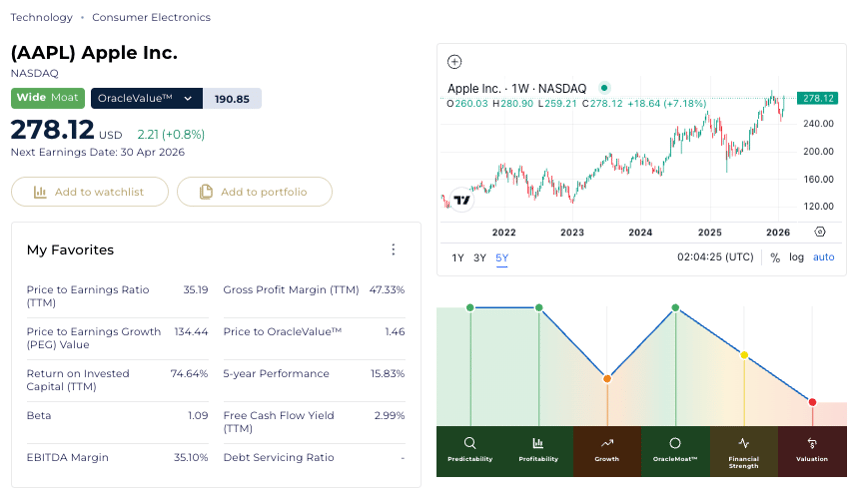

Apple (AAPL) Chart on StockOracle™ powered by TradingView - 9th Feb 2026 - Past performance is not indicative of future results.

Apple (AAPL) Chart on StockOracle™ powered by TradingView - 9th Feb 2026 - Past performance is not indicative of future results.

Q1 2026 AAPL Earnings Call

The biggest bottleneck hit the iPhone 17 lineup, where shortages in advanced 3-nanometer chip nodes capped how many units Apple could ship. iPhone demand surged 23%, well above what Apple had planned for. Management admitted it is hard to predict when supply and demand will rebalance, and the March quarter guidance already assumes these constraints persist.

The same story showed up in Wearables. AirPods Pro 3 demand was described as “amazing,” but Apple simply could not ship enough units, turning what should have been category growth into a reported decline of 2% year-on-year.

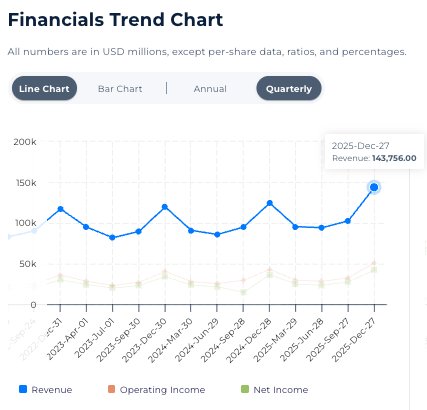

Despite all of this, Apple delivered a record-breaking quarter. Revenue hit $143.8 billion, up 16% year over year. iPhone revenue reached an all-time high of $85.3 billion, Services hit a record $30 billion, and the installed base climbed past 2.5 billion active devices.

Narrowing down, Greater China was the standout, with revenue up 38% helping Apple set all-time revenue records.

Product momentum still remained strong, with iPad leading global tablet sales, the MacBook Air as the top-selling laptop, and the Mac Mini leading desktops in December.

The negatives are still real. Mac revenue fell 7% year over year, Wearables dipped due to supply limits, operating expenses landed at $18.4 billion up 19% from heavier R&D spending, and chip constraints remain unresolved.

Apple (AAPL) Stock Analysis with StockOracle™

Apple (AAPL) powered by StockOracle™ - 9th Feb 2026

AAPL is currently trading at a Price/OracleValue™ approximately of 1.46 on 9th February 2026, indicating the stock’s OracleValue™ is estimated to be priced lower than its market price of $278.12.

StockOracle™’s OracleIQ™ Analysis on Apple (AAPL)

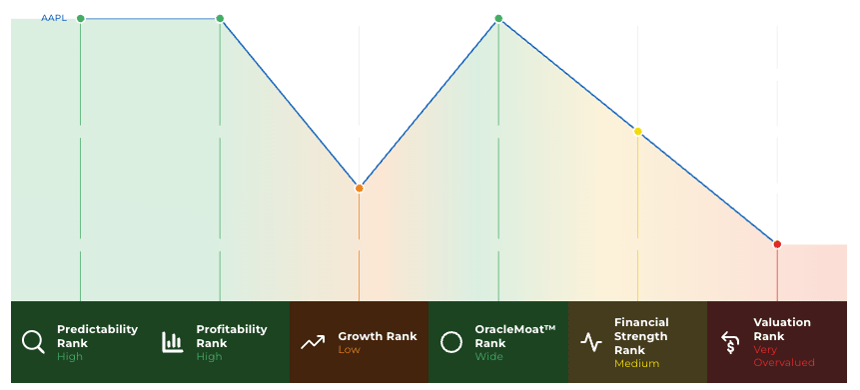

Apple (AAPL) OracleIQ™ powered by StockOracle™ - 9th Feb 2026

Apple’s OracleIQ™ profile is largely healthy, supported by high predictability, strong profitability, a wide economic moat, and decent financial standing. The business continues to execute consistently at scale. The main area that demands tighter scrutiny is valuation. With growth concentrated in iPhone and Services and limited acceleration elsewhere, Apple’s premium pricing leaves less room for error, making future returns more sensitive.

Apple (AAPL) Gross Margin chart powered by StockOracle™ - 9th Feb 2026

Apple scores high on predictability and profitability for reasons that are dull but powerful. Over the past decade, Apple’s gross margin has steadily expanded from 38% range to about 47.3%, with operating margins and net margins slowly increasing too. Q1 2026 earnings reinforced this consistency, with Q4 2025 delivering all-time high revenue.

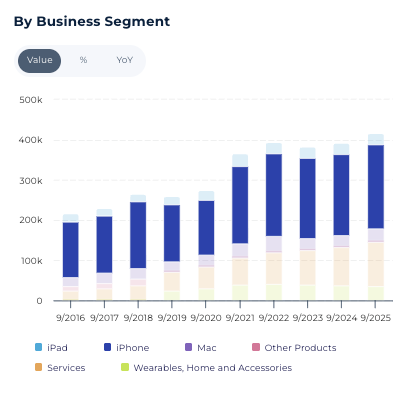

Apple (AAPL) business segment powered by StockOracle™ - 9th Feb 2026

Growth is where the shine fades a little for Apple. iPhone’s revenue makes up 50% and carries the bulk of revenue, which fuels the “one-trick pony” criticism. iPad, Mac, and Wearables while meaningful have not shown sustained breakout growth over the years.

Apple’s moat is undeniable wide and obvious. Brand, ecosystem lock-in, hardware-software integration, and switching costs do the heavy lifting. Customers don’t just buy products; they buy into a loop that’s annoying to leave. Competitors can copy features, but not easily on ecosystem stickiness at scale.

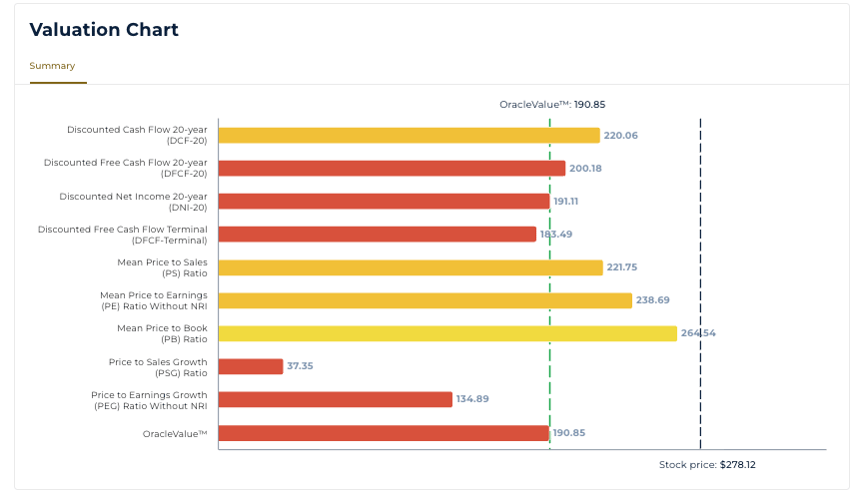

Intrinsic Value of Apple(AAPL) with StockOracle™ Intrinsic Valuation Chart

Valuation Chart of Apple (AAPL) powered by StockOracle™ - 9th Feb 2026

Don’t borrow Wall Street’s assumptions. Calculate AAPL’s intrinsic value your way. 7-day free trial.

Apple’s StockOracle™ valuation chart suggests a mismatch between price and fundamentals. The stock trades above OracleValue™ 's estimates and most intrinsic value estimates, which cluster far below the current share price.

It seems like the market is pricing Apple for sustained margins, strong moat and long-term dominance. The business remains strong, but valuation appears stretched, making future returns more sensitive to small disappointments in growth or profitability.

Intrinsic value models are long-term frameworks and assume multi-year holding periods. Short-term price movements can differ significantly from valuation estimates.