Intrinsic Value of AMZN with StockOracle™ Analysis Post Earnings Q4 2025

By Piranha Profits TeamLast updated on February 12, 2026

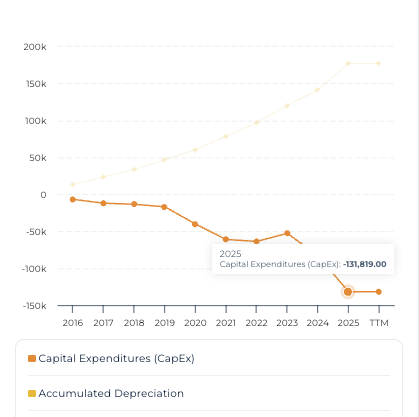

Amazon’s stock slid after earnings because investors suddenly realised how massive Amazon’s next capital expenditure is going to be.

Amazon CEO Andy Jassy said the company expects to invest around $200 billion in capital expenditures, with most of that spending directed toward AWS to meet surging demand.

The announcement marked a significant escalation in Amazon’s AI and infrastructure investments, far exceeding 2025 already substantial spending levels.

Amazon’s announcement also came in the middle of an industry-wide spending surge. Amazon, Meta, Google, and Microsoft together plan to pour hundreds of billions of dollars into AI. When everyone is spending aggressively at the same time.

The nearly 9% drop in Amazon’s share price after Amazon revealed its plans reflected those concerns. Investors seem to fear that profits could be squeezed before AI actually starts boosting revenue.

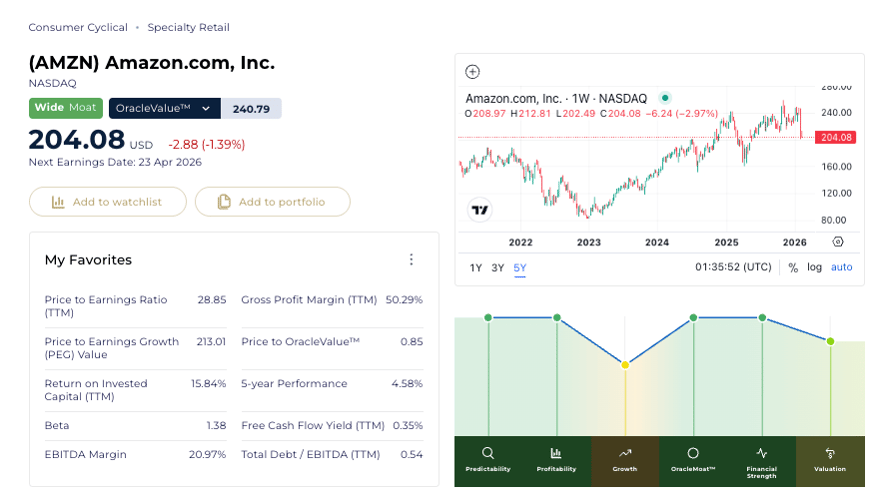

Amazon.com (AMZN) Stock Analysis with StockOracle™

Amazon (AMZN) powered by StockOracle™ -12th Feb 2026

AMZN is currently trading at a Price/OracleValue™ estimate of 0.85 on 12th February 2026, indicating the stock’s OracleValue™ is estimated to be priced attractively.

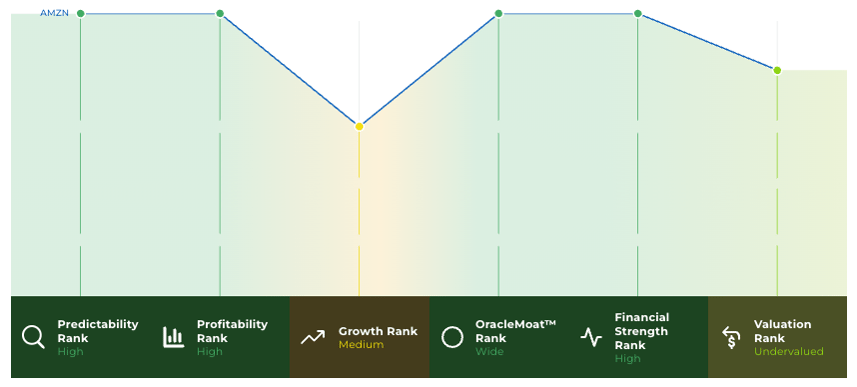

StockOracle™’s OracleIQ™ Analysis on Amazon (AMZN)

Amazon (AMZN) OracleIQ™ powered by StockOracle™ - 12th Feb 2026

Amazon’s OracleIQ™ reflects a business that has matured into a full hyperscaler, operating on the same structural level as Microsoft, Google, and Meta. The company combines predictable revenue generation, expanding profitability, entrenched competitive advantages, and exceptional financial strength.

Predictability is anchored by recurring and contracted revenue. AWS alone carries a $244 billion backlog, giving multi-year revenue visibility. Further reinforced by Prime subscriptions, third-party seller services, and everyday-essential purchases, which together creates a stable revenue base for Amazon.

Profitability wise, AWS continues to generate ~35% operating margins, retail margins are also improving and advertising adds a high-margin profit layer.

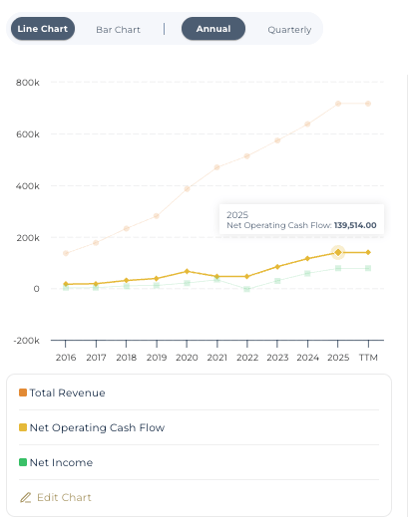

Financially, Amazon generated $139.5 billion in operating cash flow in 2025, giving it the ability to fund a significant portion of its planned $200 billion in capital expenditures without relying heavily on external financing. Strong operating cash flow means Amazon’s core businesses are producing cash consistently, not just accounting profits. Combined with its substantial cash reserves, this reduces the need to issue new debt or dilute shareholders, even during an aggressive investment cycle.

More importantly, Amazon’s return on invested capital (ROIC) has exceeded its weighted average cost of capital (WACC) for the past two years. This signals genuine value creation. When ROIC is higher than WACC, each dollar reinvested into data centers, logistics networks, or AI infrastructure is generating returns above the company’s cost of funding. In other words, Amazon is efficiently making money with their investments.

This combination of strong internally generated cash flow and disciplined capital efficiency allows Amazon to out-invest competitors while preserving balance sheet strength.

Any past performance mentioned is not indicative of future results.

Amazon’s growth rank scores medium on OracleIQ™ not because the business is not growing, but because it already operates at a scale where incremental growth becomes structurally harder.

At the same time, headwinds remain. If AI demand, pricing power, or customer adoption fail to meet expectations, high CapEx could compress returns rather than fuel the next phase of profitable growth.

Competitive pressure is also intensifying across the business. In cloud and AI, Microsoft and Google are competing aggressively for the same enterprise budgets. In retail, Amazon faces established rivals like Walmart and Target, alongside ultra-low-cost disruptors such as Temu and Shein. At the same time, regulators in the U.S. and Europe are circling its marketplace and ad business.

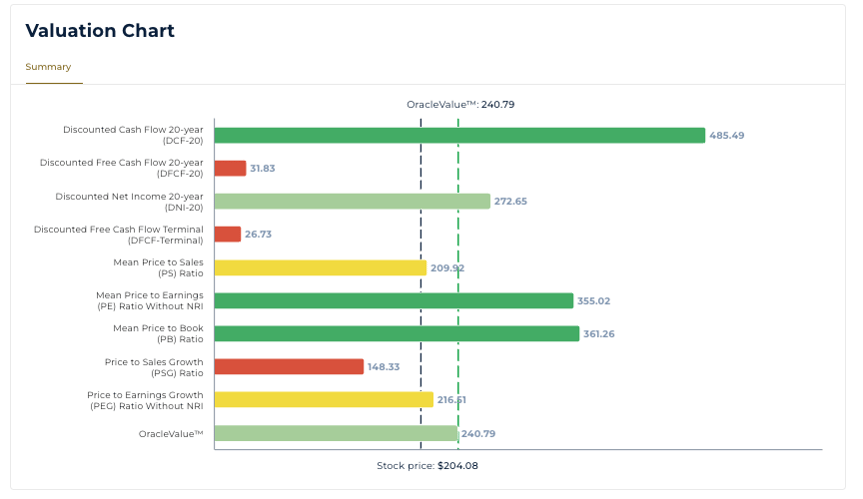

Intrinsic Value of Amazon(AMZN) with StockOracle™ Intrinsic Valuation Chart

Amazon (AMZN) valuation chart powered by StockOracle™ - 12th Feb 2026

Don’t borrow Wall Street’s assumptions. Calculate AMZN’s intrinsic value your way. 7-day free trial.

Amazon’s valuation chart places OracleValue™ in the mid-$240s, comfortably above the current stock price near $204, implying that the market is discounting a period of near-term pressure.

Free cash flow appears weak not because Amazon’s underlying business is deteriorating, but because a large portion of operating cash flow has been deliberately and consistently reinvested into capital expenditures, compressing reported FCF in recent years.

The key investor concern may not be the spending itself, but whether this elevated CapEx represents a temporary buildout or a permanent step-change in Amazon’s cost structure. If high CapEx persists, free cash flow will remain depressed, directly weighing intrinsic value estimates that rely on FCF assumptions.

If there is clearer evidence that this spending converts into sustained margin expansion rather than permanent cash burn, near-term sentiment could shift from cautious to meaningfully more optimistic.

Intrinsic value estimates are based on long-term financial projections and assume multi-year holding periods. Short-term market movements may differ significantly from valuation estimates.